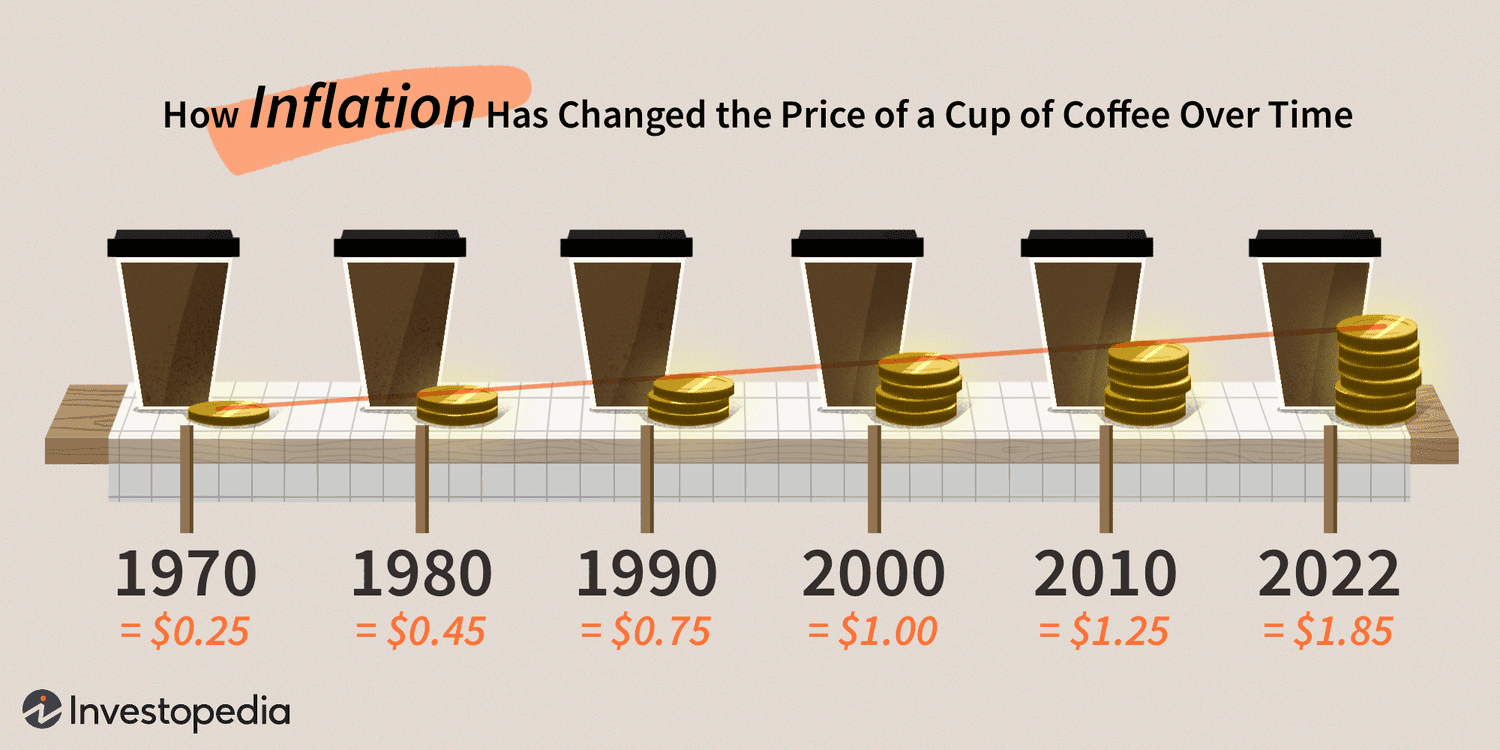

Inflation once again grazed double digits in October, advancing 30 basis points to 9.93 percent despite the government's repeated assurances of measures to rein it in.

In rural areas, it can be said that it has statistically hit double-digit: it was 9.99 percent, according to data published yesterday by the Bangladesh Bureau of Statistics. In urban areas, it was 9.72 percent, up 48 basis points.

Food inflation, which is a major reason for the elevated inflation, stayed above 12 percent for the third straight month. It was 12.56 percent in October. Non-food inflation advanced 48 basis points to 8.3 percent.

October's data means inflation averaged 9.5 percent in 2023 and 9.79 percent so far this fiscal year -- way above the budgetary target of 6 percent.

"None of the steps taken to control inflation are working," said Selim Raihan, executive director of the South Asian Network on Economic Modelling.

The decisions were taken belatedly and took a while to implement.

He went on to cite the case of the decision to allow egg imports to cool down the market.

"See how long it took for the eggs to arrive. If market intervention is so delayed, how will the prices be tamed?"

Raihan, also an economics professor at Dhaka University, called for tax adjustment to bring down the prices of goods.

"Tax revenue is not a major concern now, inflation is," he said, adding that the non-food inflation data provided by BBS is underestimated. Non-food inflation should be in double digits, he said.

Raihan went on to forecast higher inflation in the last two months of the year on the back of the supply disruption brought on by the political unrest.

Many unethical businesspeople will exploit the situation to hike the prices.

"And we have seen over the past year and a half that the government has no effective tools to monitor and address such things," he added.

Both the monetary policy-related steps taken to control inflation by the central bank were taken too late and insufficient, said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

"It is not realistic to expect their impact on inflation in October."

For inflation to be controlled from the demand side, the interest rate hike -- one of the two steps taken by the Bangladesh Bank -- needed to be much more. In reality, it was just 1.93 percentage points.

Hussain went on to cite the case of Sri Lanka, where the interest rate was hiked by 900 basis points in three months and inflation came down to 2 percent.

"How do you tame inflation with such inadequate steps on the demand side?"

The strain on the dollar stockpile is not conducive to taming inflation, he said.

Because of the foreign exchange shortage, import restrictions cannot be withdrawn. This is disrupting the supply chain directly through import repression and indirectly by hampering production.

"What is needed to alleviate foreign exchange shortage has not been done. What is being done -- which is tinkering with the dollar rate every month through BAFEDA -- is worsening the shortage as it is encouraging speculation. You have to address the supply side too to control inflation."