The members of parliament (MPs) of the National Council (NC) raised concerns that high interest rates on credit are creating barriers for farmers in availing agricultural loans.

The Economic Affairs Committee (EAC) of NC presented the report on the review of rural credit access in Bhutan yesterday in the House.

The report’s objective is to conduct a comprehensive review of the current state of rural credit access in Bhutan, identifying challenges and opportunities.

It also seeks to engage with stakeholders from government agencies, including local government (LG) functionaries, financial institutions, and rural communities, to gather insights and perspectives.

Furthermore, the report analyses existing policies and procedures related to rural credit provision, evaluates their effectiveness, and develops evidence-based recommendations for submission to the government.

The report reveals the immense challenges and opportunities in the underfunded agricultural sector, which is vital to the economy.

Currently, only 2.5 per cent of total loans are disbursed to agriculture, limiting growth and development in rural areas where many people depend on farming for their livelihoods.

The chairperson of EAC, Tshewang Rinchen, said that major constraints in rural credit access include stringent collateral requirements, high interest rates, low financial literacy, and cumbersome loan processes.

These barriers hinder small farmers from securing funds for agricultural investments. High credit risks and inadequate insurance make banks reluctant to lend to this sector. Uniform regulatory frameworks that don’t account for the unique challenges of development banks further complicate the issue.

Currently, there are five banks, two insurance companies, and five microfinance institutions in the country that serve as sources of rural credit. The main institution for rural lending in the country is the Bhutan Development Bank Limited (BDBL).

BDBL offers 37 different loan products with interest rates between 9 per cent and 15 percent. Out of these, 12 loan products are specifically suited for rural people in Bhutan.

As of March this year the overall non-performing loan (NPL) rate stands at 3.40 percent, with the highest NPL in the credit card sector at 36.88 percent.

The agriculture and livestock sectors have an NPL rate of 8.75 percent.

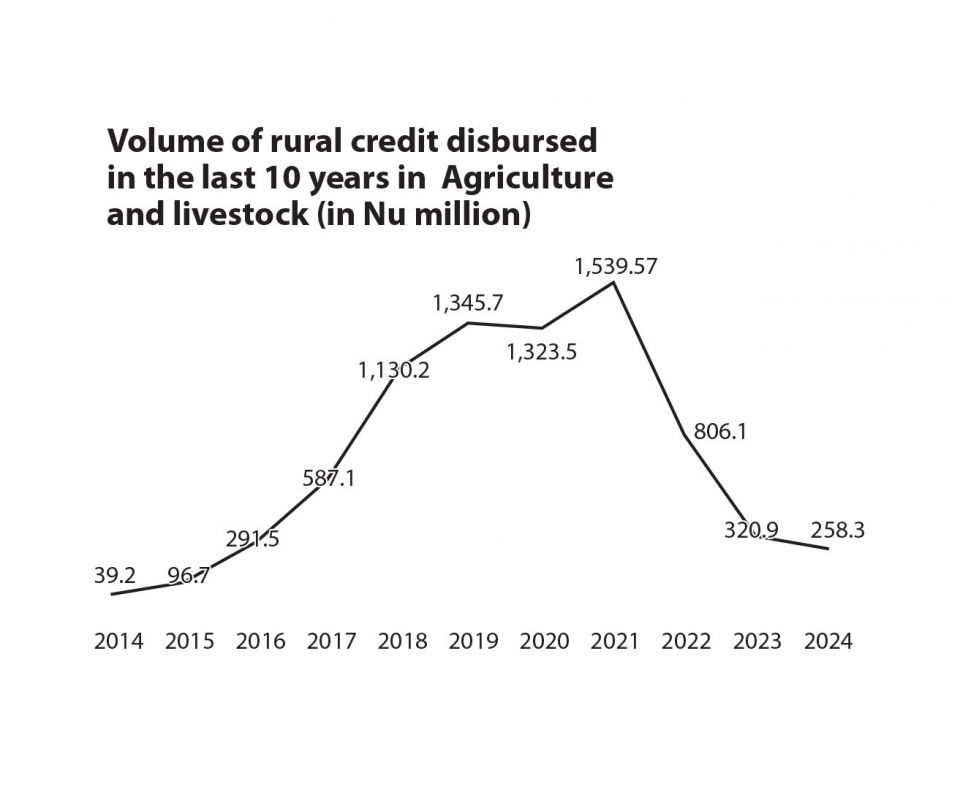

Loan disbursement in the agriculture and livestock sector saw a significant increase over the years, from Nu 39.19 million in 2014 to a peak of Nu 1.5 billion in 2021, before sharply declining to Nu 258.30 million by 2024.

Despite agriculture’s importance to the economy, it receives less than five percent of total loans. In 2022-23, agricultural credit dropped by 24.5 percent, from Nu 6.33 billion to Nu 4.7 billion. Only about 21.79 percent of Bhutanese adults have access to loans.

As of March 2024, there are 33,029 loan accounts with a total sanctioned amount of Nu 12.7 billion and a total loan outstanding at Nu 8.6 billion.

Thimphu, Trashigang, and Chukha have the highest loan activity, while Gasa, Lhuentse, and Trashiyangtse have the lowest.

In terms of credit accessibility in agriculture, 12.04 percent of total farming households in Bhutan have accessed credit.

The chairperson of the EAC said that addressing these issues required policy changes to improve credit access, targeted financial literacy programs, and better stakeholder coordination. Implementing these measures, he said, would enhance rural credit access, boost agricultural productivity, and support sustainable economic development in Bhutan’s rural areas.

The chairperson of the NC Sangay Dorji mentioned in the House that additional suggestions from members would make the review report more comprehensive and concrete for tabling during the winter session.

MP Sonam Tobgyel from Trashigang suggested that the committee should also consider extending the tenure of loan repayment for farmers and increasing the loan amount ceiling.

Eminent Member Phuntsho Rabten recommended examining the overall distribution of loans by account holders, noting a significant disparity in loan disbursement across different dzongkhags.

Deputy Chairperson TsheringLa said that compared to other commercial banks in the country, BDBL had the highest interest rates, which deterred farmers from availing themselves of the credit facility.

He also said that the gewogs face difficulties when availing loans, as they have to travel to dzongkhag headquarters, incurring additional expenses.

He suggested that branches should also be opened in drungkhag offices.

The EAC will consult with relevant stakeholders and submit the final review report with recommendations to the House during the 34th Winter National Council session.