The Royal Monetary Authority (RMA) extended the incentive scheme for inward remittance for Bhutanese who live, work or study overseas for another six months beginning yesterday.

The authority also increased the incentives from 1 to 2 percent. According to the RMA’s press release, the increase was in recognition of the significant contributions made towards boosting the remittance inflow since May 2021 and the foreign currency reserves and promoting savings and investments.

The beneficiaries will receive an enhanced cash incentive of 2 percent upon converting the remitted amount in Ngultrum using the prevailing exchange rates through banking channels and the international money transfer operators, a press release from RMA stated.

However, the authority stated that the incentive will not be applicable for the remittances received for the purpose of foreign direct investments, donations, and trade, including remittances received in favour of non-governmental organisations, civil society organisations, and companies.

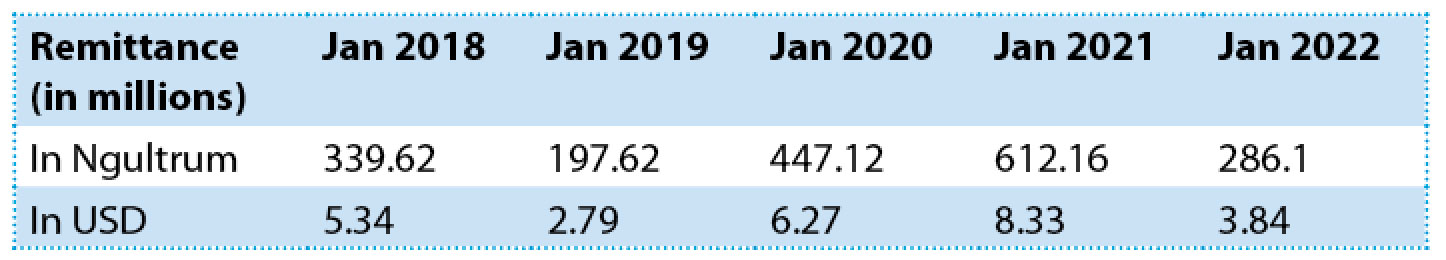

RMA’s latest monthly statistical bulletin reported a remittance of Nu 286.1 million (M) equivalent to USD 3.24M in January this year.

Remittance in January this year decreased by over 50 percent from the same month last year mainly because of a decrease in the Australian dollar remittance. In January, last year Bhutan received remittances at Nu 612.16M of which Nu 427.74M was denominated in Australian dollars.

More than half of the remittances received in January this year are denominated in USD, amounting to USD 2.05M equivalent to Nu 152.28M. One-third of remittances were from Australia at Nu 101.76M equivalent to Australian dollar 1.9M.

Statistics from the authority also show that the remittances had increased drastically from Nu 2.9 billion (B) in 2019 to Nu 8.269B in 2020 during the pandemic. However, it declined by 2.5 percent to Nu 8.062B last year.

Remittance is a transfer of money by foreign workers (non-resident Bhutanese) back to their home country, which helps to improve the foreign exchange reserves and reduces the deficit in the current account by improving the country’s balance of payments.

According to the finance ministry in budget report 2022-23, Bhutan’s gross international reserves were estimated to deplete to USD 1.33B this fiscal year from USD 1.56B in the previous fiscal year.

Of the total, convertible currency reserves are estimated at USD 1.157B and Indian Rupee reserves at Nu 13.076B (USD 171.6M).

The total reserves would be sufficient to finance 22 months of essential imports which is more than mandated by the Constitution.

The Constitution mandates maintaining a minimum foreign currency reserve adequate to meet the cost of not less than one year’s essential import.

However, the finance ministry warns that the declining trend of reserves with no new investments generating foreign exchange earnings with a significant increase in imports could possibly risk the pegged exchange rate regime.

To encourage remittance inflow, the authority launched a cash incentive scheme for Bhutanese overseas in a pilot phase from June 1 last year up to May 22 this year.

The RMA also launched the RemitBhutan in September 2016 to provide a platform for non-resident Bhutanese to remit their savings and earnings to Bhutan through the formal banking channel. There are currently 2,534 accounts with RemitBhutan.