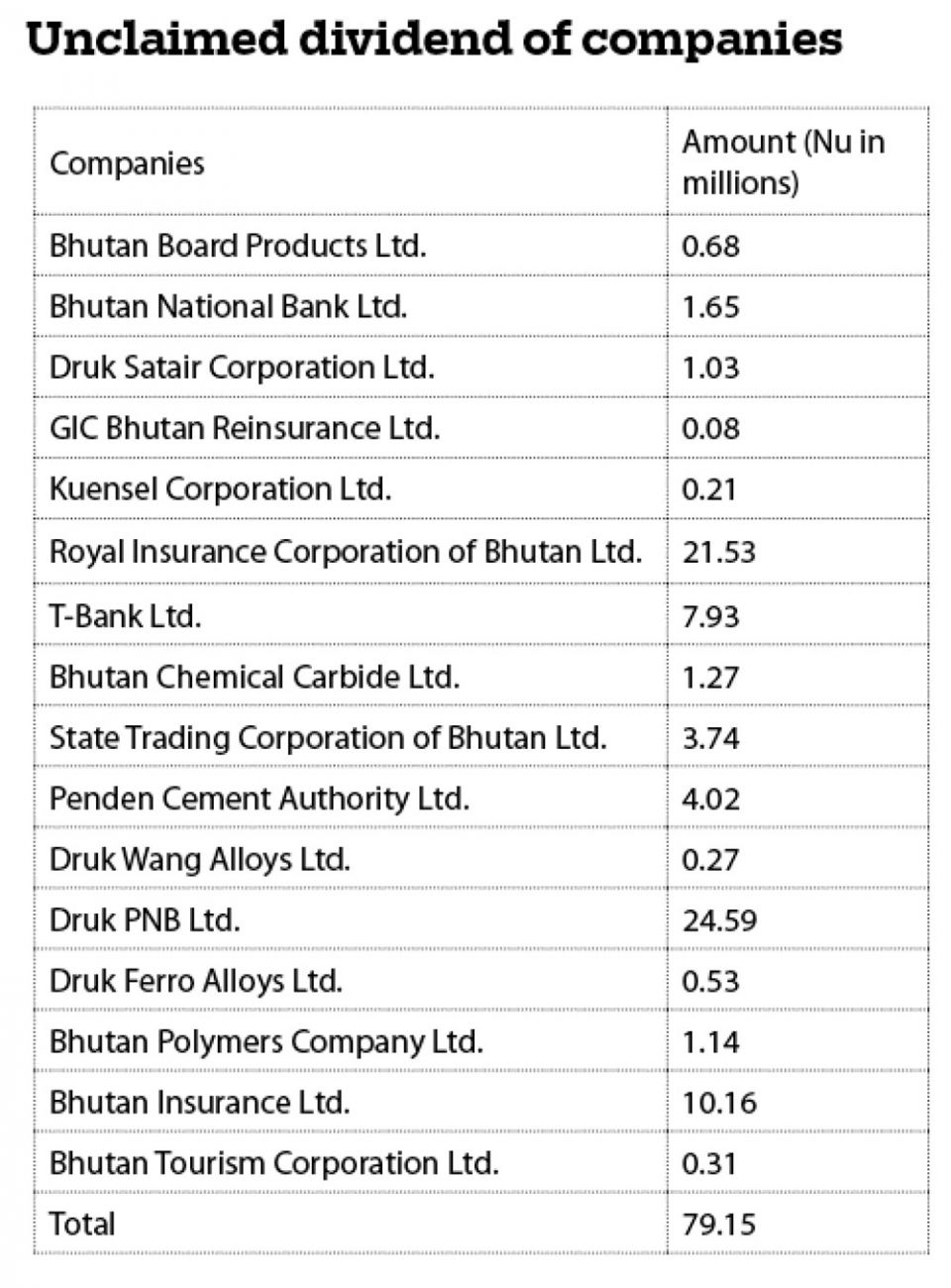

The Royal Securities Exchange of Bhutan (RSEB) has recently discovered Nu 79.15 million in unclaimed dividends from 16 out of the 19 listed companies. These unclaimed dividends have accumulated over time.

According to data from the RSEB, the highest amount of unclaimed dividend, totalling Nu 24.59 million, belongs to Druk PNB Bank. Following closely behind is the Royal Insurance Corporation of Bhutan, with unclaimed dividends amounting to Nu 21.53 million, and Bhutan Insurance, with Nu 10.15 million left unclaimed.

Two companies listed in the stock exchange, Sherza Ventures and Dungsum Polymers, have not declared dividends since their inception. It has been found that Druk Satair had decided to voluntarily wind up the company following a general meeting.

An official from the RSEB has expressed concern over the low level of financial literacy among shareholders regarding capital market aspects and shares. Many shareholders, it appears, are not motivated to claim their entitled dividends due to a lack of understanding or awareness.

A significant portion of the unclaimed dividends can be traced back to shares acquired during initial public offerings (IPOs), which refer to the process of offering shares to the public in new stock issuances.

An official explained that shareholders had failed to update their information in the RSEB’s central depository. This is often due to outdated five-digit identity card numbers and inactive bank accounts. The central depository serves as a stock repository, similar to a bank but specifically for stock-related transactions.

To claim their dividends, shareholders must either visit the RSEB office or email their updated information, which includes their name, bank details, citizenship identity card number, taxpayer number, and present address.

In cases where the account holder of shares has passed away, the shares can be transferred to the spouse or children upon the court’s transition order, according to the official.

It is important to recognise that owning shares in a company grants shareholders a stake in the company’s operation and performance. Shareholders become part-owners of the company and, consequently, are subject to the risks and returns associated with the company’s performance. If the company generates profits, shareholders receive dividends; otherwise, they may incur losses.

In instances where shareholders inquire about dividends even after companies have been delisted from the stock exchange, the unclaimed dividends and asset liquidation amounts are maintained in the stock exchange’s escrow account. This measure has been taken by the RSEB due to the absence of proper policies or regulations, aiming to prevent potential misuse by the company or promoters.

RSEB, in collaboration with the Registrar of Companies under the Ministry of Industry, Commerce, and Employment, is planning to establish an investor protection fund using the unclaimed dividends from delisted companies. The interest generated from this fund will be used to provide awareness programmes for shareholders and investors.

If shareholders fail to claim their dividends for a period of 10 years, the funds could be transferred to the finance ministry, an official said.

Some of the delisted companies are Bhutan Diary Agro Products, Druk Petroleum Corporation, Jigme Mining Corporation, and SD Eastern Corporation.