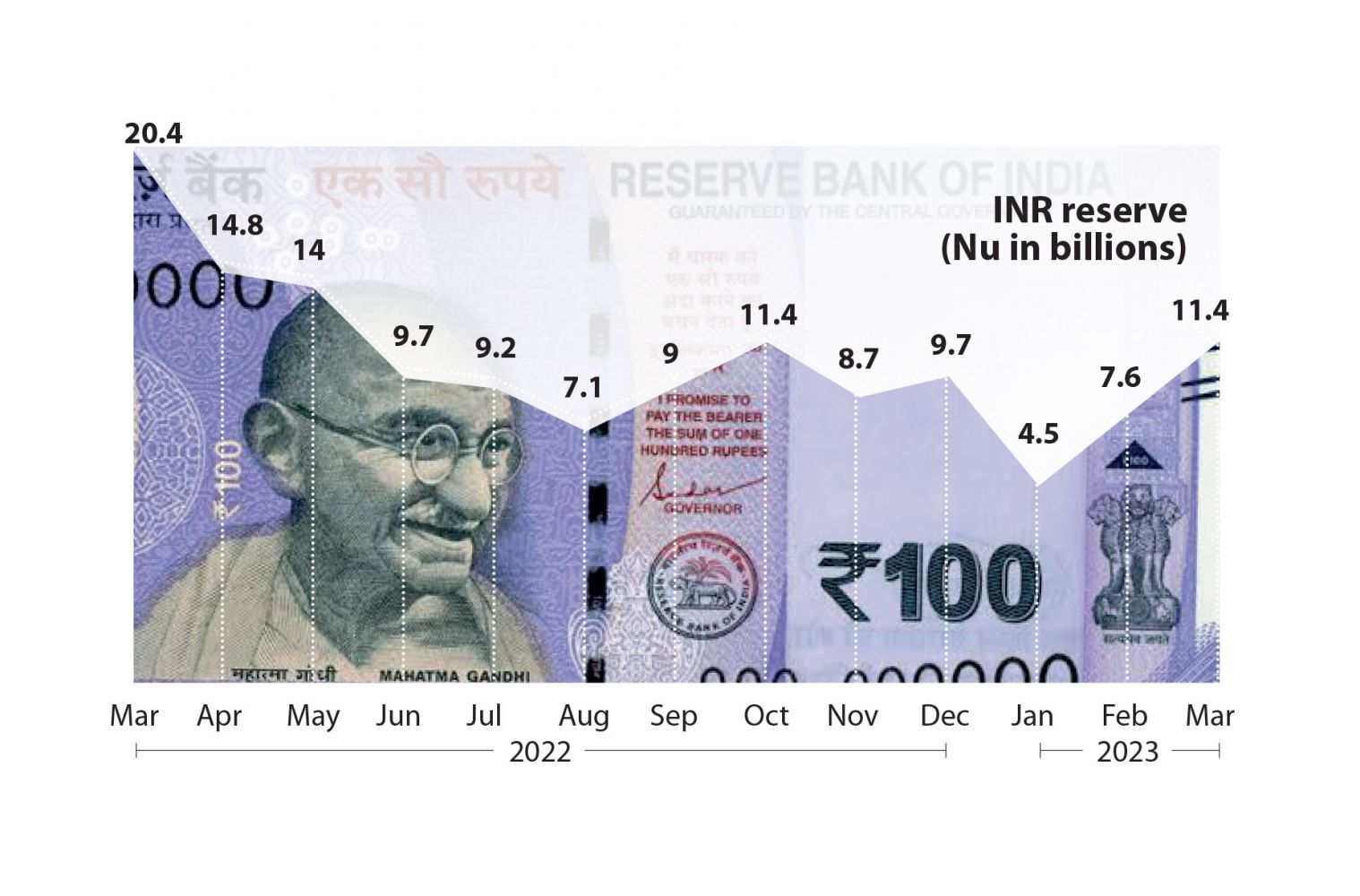

… rupee reserve declined to a low of Nu 4.48 billion in January

The country’s growing imports and declining exports have depleted Bhutan’s rupee reserve by 44 percent as of March this year compared to the same month in 2022.

The rupee reserves had dropped from INR 20.38 billion in March 2022 to INR 11.42 billion in March this year, according to the Royal Monetary Authority’s (RMA) provisional figure. This was adequate to meet 1.53 months of merchandise imports.

In January this year, Bhutan saw a low of INR 4.48 billion, adequate to meet only 0.56 months of merchandise imports after the country experienced a rupee crunch a decade ago.

For an import-driven country, the rupee reserve is necessary as more than 80 percent of the country’s imports are from India.

Bhutan Import figures at Nu 24.15 billion from India in the first quarter of this year indicate that Bhutan imported Nu 268.32 million worth of goods daily. The import figures in the first quarter were an increase of Nu 8.11 billion from the same period of last year.

The reserves have been declining because of a lack of earnings from tourists and decreased export for more than two years because of the pandemic.

An observer said that the rupee reserve was affected because of the fewer Indian tourists visiting Bhutan with the revised sustainable development fee of INR 1,200 per person per night and visitors driving their vehicles in Bhutan have to pay INR 4,500 per vehicle per night.

At the same time, Bhutan’s exports declined by 2.5 percent to Nu 9.52 billion in the first quarter from last year’s quarter. Electricity exports to India decreased by about 70 percent, falling from Nu 721.84 million to Nu 218.51 million because of poor hydrology.

Similarly, the country’s top export, ferrosilicon, saw a decrease of about 23 percent to Nu 3.73 billion in the first quarter compared to Nu 4.58 billion in the previous same quarter.

In the wake of inadequate rupee reserves, a few weeks ago, Bhutanese importers faced the problem of delayed payment to their Indian counterparts through the real-time gross settlement (RTGS) service provided by financial institutions.

President of Hardware Association of Bhutan, Thinley Dorji said the payment through RTGS gets delayed by a week, compared to earlier when the Indian counterparts received the payment in a day or two.

“When payments are not made, the Indian business counterparts do not send us the consignment,” he said.

President of the Construction Association of Bhutan, Trashi Wangyel said that the construction industry faced a brief problem with banks exhausting their Indian rupee limits with their counterparts in India. However, he said that the issue has been resolved.

Trashi Wangyel also said that if the foreign workers (Indians) in Bhutan are unable to send money, they manage with Indian currency-Bhutan currency exchange at the border town paying a certain amount as commissions.

“These transactions are detrimental to our ngultrum losing value against the Indian rupee but it is a bitter truth at the moment when our country is going through difficult foreign currency reserves,” he added.

Trashi Wangyel expects that the country’s whole economic problem would be resolved with the upcoming budget plans and transition from the 12th to 13th five-year plan.

In the rupee crisis, the RMA has an internal arrangement through a standby credit facility with the Reserve Bank of India (RBI) where the RMA can borrow rupee. Bhutan already has two-rupee standby credit facilities of INR 3 billion and INR 4 billion which were lent by RBI in 2012 and 2013 respectively.

The country can also sell reserves denominated in USD to buy rupees during the crisis from Asian Development Bank and World Bank. However, the country needs to have adequate convertible currency reserves.

The country’s reserve in USD was recorded at USD 559.4 million as of March this year, adequate to meet 24.16 months of merchandise imports. However, the total reserves, including USD and rupee at USD 698.3 million were adequate to meet only 13.9 months of essential imports.

Remittances are also one of the major sources of foreign reserves in Bhutan. The RMA’s figure shows an inward remittance of Nu 1.2 billion equivalent to USD 14.61 million in the first two months of this year. This was an increase of Nu 593.06 million or USD 6.39 million compared to the same period last year.

Sharing on remitting challenges, the Co-founder of DrukSmart, an ITES foreign direct investment company, Pema Tshering said that remittances from Middle-east in SAR (Saudi Riyal) and AED (United Arab Emirates dirham) are not allowed since SAR and AED are not acceptable convertible currencies under the purview of RMA.

He added that the remittance can only be made in USD currency. “This leads to converting SAR and AED contracts into USD leading to low margins due to higher forex cost.”

Oftentimes, Pema Tshering also said that the remittance from outside takes weeks to be remitted in the company’s current deposit account in a bank in Bhutan and banks normally do not have a clue where money is lying when the company follows up with the bank.

“For outside remittance through RTGS, the payment also takes longer to be remitted to their account owing to bank process and required RMA approval in many cases,” he said.

DrukSmart, a company earning revenue in convertible currencies where resources are deployed at the project site outside Bhutan and where payments need to be made monthly, Pema Tshering said that there is no smooth payment mechanism like debit cards which can be loaded with the monthly daily subsistence allowance or per diem in convertible currency. He added that there is an issue of forex cards not readily available.

“If available, the RMA dollar limit per year restricts us from making monthly payments to our employees working at customer locations outside Bhutan,” Pema Tshering said.