* Official data showed Wednesday that China has well achieved its major economic development targets for 2023, a hard-won outcome amid downward pressure due to domestic and international challenges.

* Some overseas judgements on the world's second-largest economy, including massive foreign investment flight, persistent deflation and crisis-ridden growth outlook, are overstatements upon a closer inspection.

* Huge market scale, ample policy tools and accelerating shift to high-quality development, among others, underpin China's potential and capability to sustain long-term growth.

BEIJING, Jan. 18 -- China on Wednesday disclosed the full-year performance of its major economic indicators for 2023, providing a robust response to some negative perspectives on the world's second-largest economy.

Following major shifts in its COVID-19 response in early 2023, China's economic operations garnered considerable attention, with the normal fluctuations during the post-pandemic recovery phase sparking speculations and discussions globally.

The following are four key areas where pessimistic predictions against the Chinese economy were exaggerated, and when viewed in perspective, proved to be premature misjudgments.

ON RECOVERY STEAM

Following a robust performance in the first quarter of 2023, the Chinese economy posted a relatively weak recovery in Q2 amid downward pressure due to growing global uncertainties and insufficient domestic demand.

At that time, several international investment banks lowered their forecasts of China's GDP growth for the year. These adjustments were subsequently highlighted by foreign media, supporting the narrative that the country was losing momentum in its economic recovery and facing challenges in achieving its annual GDP expansion target of around 5 percent.

To consolidate economic recovery, China swiftly introduced an array of pro-growth policies, ranging from adjustment of mortgage rates to nurturing a more facilitating environment for private and foreign firms and rolling out targeted tax and fee cuts.

The policy mix proved effective. China's GDP expanded 4.9 percent year on year in Q3, up 1.3 percent over Q2, and its Q4 GDP rose 1 percent over Q3, according to the National Bureau of Statistics (NBS). The full-year GDP growth reached 5.2 percent, well within the projected range.

China's GDP growth in 2023 is not only higher than the global estimated growth rate of about 3 percent, but also stands out as one of the strongest performances among the world's major economies, NBS head Kang Yi told a press conference on Wednesday, adding that the Chinese economy is expected to contribute more than 30 percent to global GDP expansion in 2023, making it the strongest driving force powering world economic growth.

ON INVESTMENT APPEAL

Since the first half of 2023, "de-risking" has been hyped among officials in Washington and some Western capitals, tooting the "necessity" to cut supply and market reliance on China.

The rhetoric sparked concerns about tensions in international relations, prompting certain foreign companies to contemplate diversifying their global footprint to mitigate geopolitical risks, a move labeled by some foreign media as "fleeing China."

"European companies are not running for the exit. That's not what we've seen. We see that by and large most of our companies remain very committed to the Chinese market, and we are here for the long run," said Jens Eskelund, president of the EU Chamber of Commerce in China.

The reality is that more international firms have opted for growing engagement with the huge Chinese market. The sixth China International Import Expo saw a record attendance of U.S. firms. Exhibitors from 55 countries and regions participated in the inaugural China International Supply Chain Expo. A total of 48,078 foreign-invested firms were registered in China in the first 11 months of 2023, up 36.2 percent year on year.

"After one year, I'm even more convinced that 'the next China' is China," said Joe Ngai, chairman of McKinsey & Company in Greater China, adding that it's hard to find another market that can offer the business growth at the same quality, course and value for money.

ON PRICES

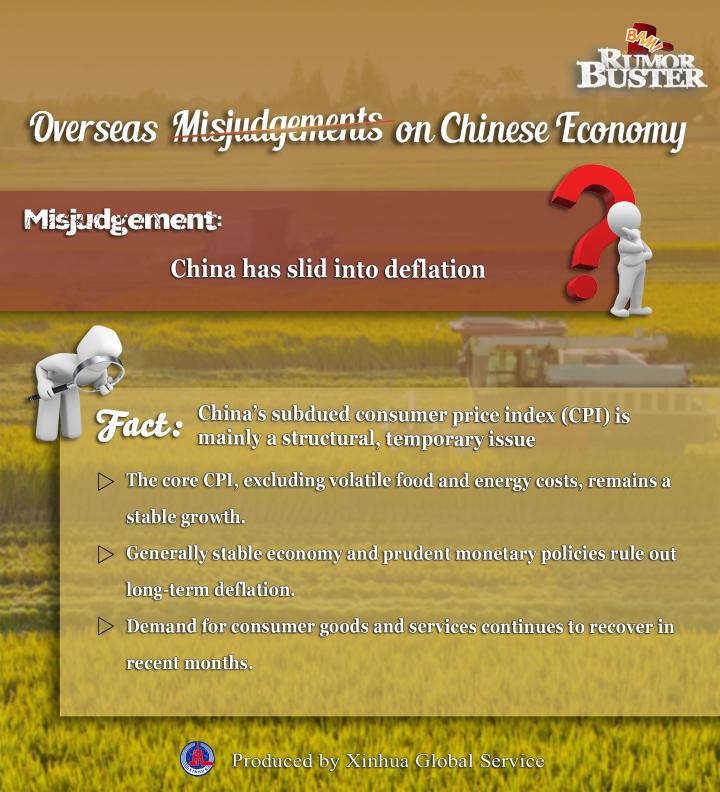

While some countries worldwide continued to combat rising prices last year, China saw a different trajectory of price changes. The country's consumer price index (CPI), a main gauge of inflation, has seen its year-on-year growth hover around zero since the first half of 2023.

Many foreign media jumped to the conclusion that China has slid into deflation, and even hyped the possibility of a long-term deflation.

"The headline inflation clearly has come down quite a bit, but we see that as being driven mainly by food prices and energy prices. We don't expect to see a general deflation trend in China," Gita Gopinath, first deputy managing director of the International Monetary Fund (IMF), told a press conference in November.

A breakdown of the index indicates that the CPI's low-range performance is mainly a structural issue. The core CPI, which strips out volatile food and energy prices, has posted a rather stable year-on-year growth in 2023.

"Prices will remain low in the short term and return to normal levels in the future," the People's Bank of China said in a quarterly report, noting that in the medium and long term, there is no basis for long-term deflation or inflation for China.

ON GROWTH OUTLOOK

While achieving a GDP growth of around 5 percent for 2023 seemed assured for China since Q4, the country's potential and capability to maintain stable economic growth in the future continue to be under the spotlight.

In early December, credit rating agency Moody's cut its outlook on China's government credit ratings to negative from stable, and projected the country's annual GDP growth to be 4 percent in 2024 and 2025.

While the property sector, once a major pillar powering China's economic growth, is in a period of adjustment, new growth drivers including services and high-tech manufacturing are gaining momentum.

Official data released on Wednesday showed that in 2023, the added value of services accounted for 54.6 percent of GDP, up 1.2 percentage points over 2022. The contribution rate of final consumption expenditure to economic growth reached 82.5 percent, rising by 43.1 percentage points over the previous year. Investment in high-tech industries increased by 10.3 percent year on year.

China's GDP per capita reached 89,358 yuan (about 12,555 U.S. dollars) in 2023, indicating considerable potential for growth.

China is still in a catching-up stage and the government has a lot of policy firepower to boost the economy, said Morgan Stanley Chief China Economist Robin Xing. "For the next three to five years, we believe China can still deliver a decent growth."