At a startup factory in Hosur, a southern Indian city not far from Bangalore, the assembly line is buzzing with lightning-fast activity.

Here, workers in black uniforms churn out a brand-new electric scooter every 90 seconds, while executives review the company’s skyrocketing sales.

“Two-wheelers are going electric crazy fast,” says Tarun Mehta.

Mehta is the 33-year-old CEO of Ather Energy, an electric scooter manufacturer that has enjoyed a recent explosion of demand.

Three years ago, the company sold about 200 units a month, he said. Now, it easily clears about 15,000 units monthly.

“Revenues are skyrocketing,” Mehta told CNN.

This is what India looks like as it electrifies its vast personal vehicle market, which is projected to become a $100 billion industry by 2030. In the world’s most populous country, two and three-wheelers are the main focus, outnumbering other means of transport, such as cars, by about four times.

Walking down a street in New Delhi or Bangalore is proof enough. Electric mopeds that sell for as little as $1,000 now zip along many congested roads. They’re touted by environmentalists and the government as a way to clear some of the toxic smog that often chokes metropolises across the country.

Registrations for such vehicles have shot up more than 10 times nationwide in the last three years. In the Indian capital, many colorful rickshaws, once powered by human pedaling, now run on batteries as they shuffle passengers across town.

Established players, such as Hero MotoCorp, the world’s biggest maker of two-wheelers, have invested heavily in electrifying their offerings.

Like many countries, India is racing to go green, with a goal of having electric vehicles (EVs) account for a third of all private car sales and 80% of two- and three-wheeler sales by the end of the decade. By doing so, the country hopes to provide a model for other developing nations.

But to get there, experts say several big hurdles stand in the way, including bringing down prices and improving infrastructure.

Two-wheeled ‘revolution’

“Over the last three years, a significant amount of momentum has been brought into the market,” said Brajesh Chhibber, a McKinsey partner who co-leads the firm’s think tank on future mobility in India.

Last year, almost 7% of all two-wheeled vehicles sold were electric vehicles — rising from an “almost negligible number of units three years ago” to 1 million, he noted.

“That’s an incredible jump.”

The push has been fueled by strong state support, particularly through a policy known as “FAME,” or the Faster Adoption and Manufacturing of Electric Vehicles.

The program, which started in 2019, is pouring more than 100 billion rupees (about $1.2 billion) into subsidizing EVs for consumers and setting up thousands of EV charging stations across the country.

Subsidies have played a huge role in the recent wave of adoption.

For instance, a high-speed two-wheeler in Delhi may now cost just 15% to 20% more than its diesel-powered equivalent when factoring in federal and state subsidies, according to Bain, compared to up to 30% without subsidies. That’s helped incentivize many consumers to make the switch.

Ather, which sees the transition as nothing short of a “revolution,” is one of dozens of startups benefiting. It joins at least 55 other EV manufacturers that have sprung up to meet demand, according to government data.

India, however, is just getting started. Despite hitting a milestone, the 1 million units sold last year is a mere drop in the bucket compared to “India’s total two- and three-wheeler fleet stock of 250 million — leaving immense room for sustained growth,” according to the World Economic Forum (WEF).

Because public transport is relatively underdeveloped, these types of vehicles — scooters, motorcycles and rickshaws — are hugely important, accounting for a staggering 80% of all vehicle sales.

The trend gives the country a leg up as it shifts to EVs, because such vehicles are typically used more for daily short commutes versus long-distance drives, according to experts.

A Vietnamese electric carmaker is now worth more than Volkswagen and Ford

In a report last December, Bain predicted two- and three-wheelers would be the “the vanguards for EV adoption,” in part because users may have less range anxiety, relying less on public charging infrastructure and more on “the adequacy of home charging.”

Another driving factor is early adoption by delivery and logistics companies, which are drawn to the lower operating costs of going electric and efforts to lower their carbon footprints.

Bain cited e-commerce behemoth Flipkart and food delivery giant Zomato, as examples of companies that had already pledged to switch entirely to EVs by 2030.

Room to grow

But despite the hype and promotion, experts say three core challenges remain.

Like elsewhere, India is lagging in charging infrastructure. Authorities are working to change this, commissioning new charging networks in 68 cities across 25 states, as well as dozens of highways or expressways, according to a July statement from the Ministry of Heavy Industries.

But India is one of the world’s biggest nations, with thousands of cities and 28 states, as well as many sprawling, underdeveloped rural areas.

That means the country still has a long way to go — and a lot of money to put in. WEF estimated in a November report that approximately $285 billion is needed to fully electrify India’s two and three-wheeler markets.

Electric two-wheelers on display at the Hero Electric Vehicles headquarters in Gurgaon, India, in 2021. Hero is one of dozens of manufacturers benefiting from the shift to EVs across the country. Anindito Mukherjee/Bloomberg/Getty Images

Electric two-wheelers on display at the Hero Electric Vehicles headquarters in Gurgaon, India, in 2021. Hero is one of dozens of manufacturers benefiting from the shift to EVs across the country. Anindito Mukherjee/Bloomberg/Getty Images

Anmol Singh Jaggi, CEO of BluSmart, an Indian ride-sharing company that uses an all-electric fleet, calls the lack of charging stations his “biggest hurdle.”

“Although we have built some very large super hubs … we still feel deeply constrained by large-scale charging infrastructure being there,” he told CNN. “I think the government needs to do more about [it], more than just fiscal incentives.”

A man charging an EV at a BluSmart charging hub in Gurugram, India, in December 2022. BluSmart is an Indian ride-hailing startup that uses an all-electric fleet, relying heavily on charging infrastructure. Anushree Fadnavis/Reuters

A man charging an EV at a BluSmart charging hub in Gurugram, India, in December 2022. BluSmart is an Indian ride-hailing startup that uses an all-electric fleet, relying heavily on charging infrastructure. Anushree Fadnavis/Reuters

And even with generous subsidies, consumers in some circles remain skeptical about EVs.

Experts say more education is needed as customers question the csafety, reliability or value of battery-powered vehicles. Some consumers believe the prices of these models are still too high.

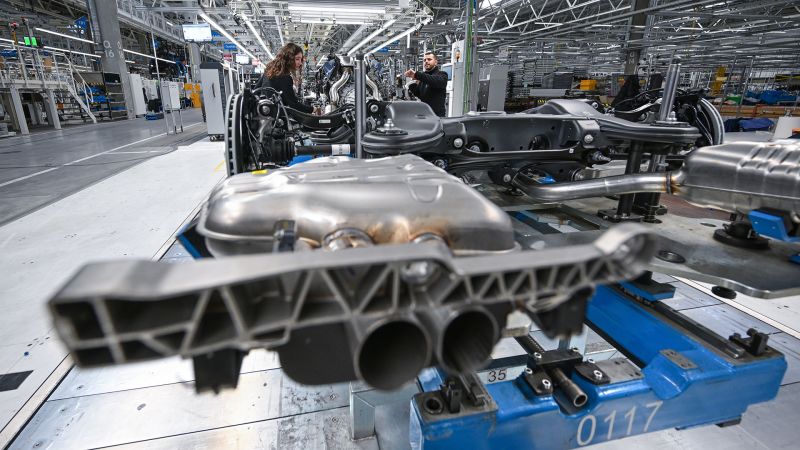

EU was set to ban internal combustion engine cars. Then Germany suddenly changed its mind

Chhibber said more time was needed for people to come around on the economic benefits of going electric, such as savings on fuel or maintenance costs.

Makers of two-wheelers argue that with the relatively high cost of fuel in India, it takes less than a year for the owner to start seeing savings from the purchase an electric scooter or motorcycle, compared to the cost of operating a vehicle with a combustion engine.

“There is still a bit of a hesitance on buying electric cars,” Chhibber noted. “In future, as battery prices go down, as vehicle manufacturers gain scale, overall the equation will balance out.”

Officials and entrepreneurs think so, too.

Jaggi, who runs a fleet of more than 4,000 cars, said he had long been bullish on predictions “that the cost of batteries will continue to drop, and the efficiency of the batteries will continue to rise.”

“It’s going to create opportunities for a lot of young entrepreneurs like ourselves,” he said. “This is a once-in-a-century kind of opportunity.”