The government is set to announce new budget with record deficit of Tk2,57,885 crore

Poor and lower-income groups faced hard realities as a result of last year's high commodity prices. With such severe inflationary pressure, the government's major concerns in finalizing the FY24 budget are limited revenue income and compliance with IMF loan requirements.

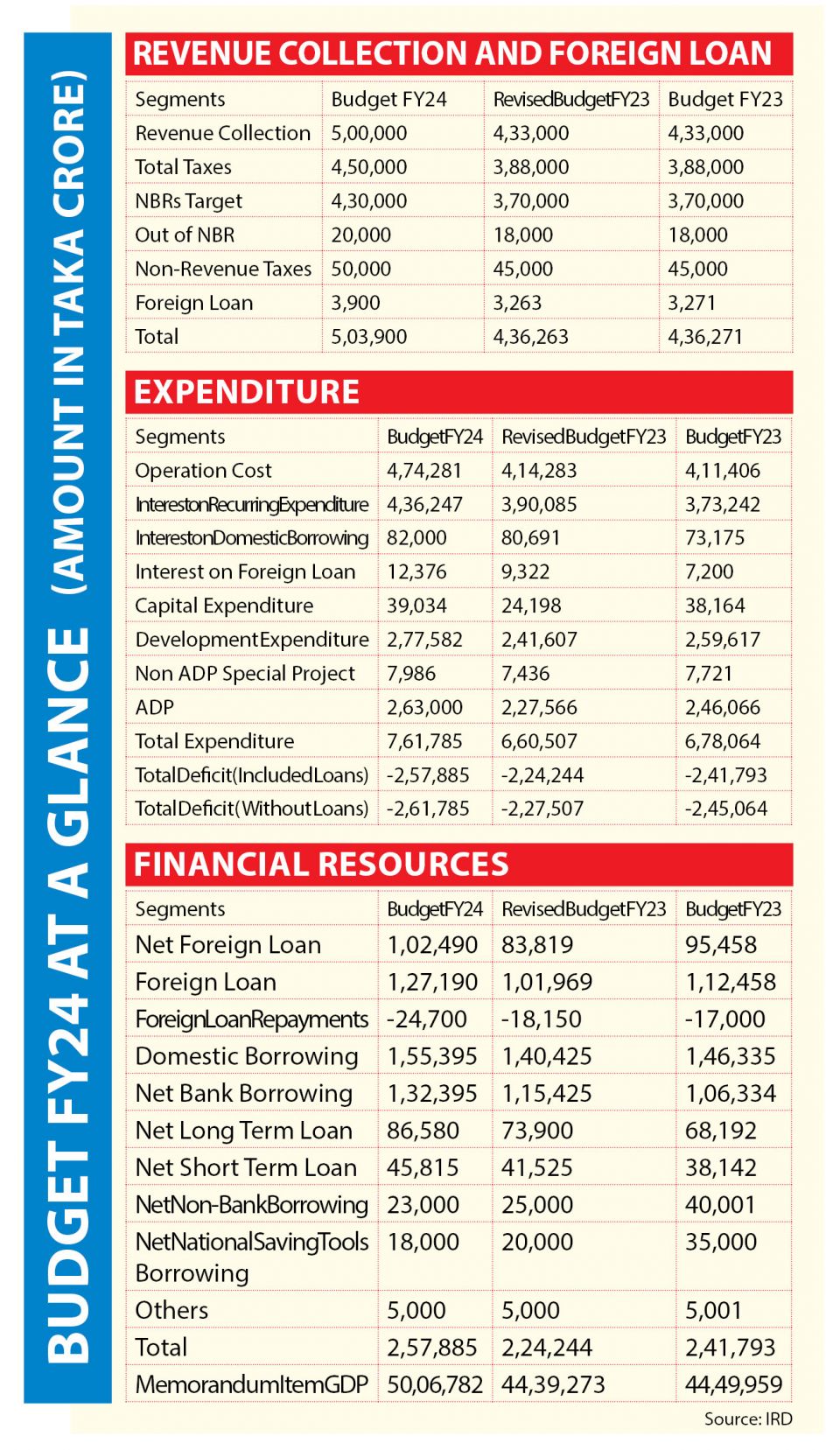

The record budget of Tk7,61,785 crore has a record deficit of Tk2,57,885 crore when foreign funding and loans are factored in.

The country's average inflation rate at the end of 11 months was 8.04%, compared to the government's target of 5.6% for FY23. However, inflation in the upcoming fiscal year (FY24) is projected to be only 6.5%.

As a result, experts believe that, like last year, the inflationary target is highly unachievable.

This is an increase of Tk1,01,278 crore over the existing revised budget. To meet the massive spending, a total revenue target of Tk5,03,900 crore has been set up, including foreign aid. To do this, an additional Tk67,637 crore must be collected over the revised FY23 budget.

Foreign grants are projected to total Tk3,900 crores. Foreign grants are not required to be returned to the government. As a result, income has been linked to the revenues from this sector.

On the other hand, analyzing National Board of Revenue (NBR) revenue collection data, think tanks such as the Centre for Policy Dialogue (CPD) and Policy Research Institute (PRI) have projected a deficit of around Tk55,000 crore against the NBR's revenue target of Tk3.7 lakh crore, but the government has given NBR a new revenue target of Tk4.3 lakh crore in the budget announced on Thursday.

Not only that, the taka has lost roughly 25% of its value versus the US dollar, while reserves have decreased by about 30%.

Meanwhile, there are other groups that are abiding by International Monetary Fund (IMF) loan conditions.

The IMF conditions stipulate that some of them have to be implemented by this year.

In such a situation, the amount of tax revenue collection has been increased by Tk62,000 crores over the FY23 target.

According to the IMF, tax revenue should be increased by Tk65,000 crores in FY24 and as per the conditions of the IMF, the budget deficit has been reduced as a ratio to GDP.

To meet this deficit budget, the government has to borrow more from foreign loans and the domestic sectors.

On the other hand, the foreign loan target is being increased at a massive rate to meet the shortfall in the government's debt as a result of reducing the sale of Savings certificates.

It has been anticipated that Tk18,671 crore higher foreign loans will be taken in FY24 than in FY23. In addition, due to high indebtedness, additional money will be needed in FY24 to pay interest on domestic and foreign borrowing.

According to sources, foreign loans worth Tk 1,02,490 crore will be taken in FY24. The foreign loan objective in the FY23 revised budget was Tk83,819 crore.

In addition, Tk1,15,395 crore is being borrowed from domestic sources.

However, under the terms of the agreement, a target of Tk17,000 crore less borrowing than the present aim has been set from the National Savings Certificates because the IMF requires a gradual reduction in borrowing through the Savings Certificates.

Bank borrowing, another internal government borrowing source, is seen as a key weapon in combating the deficit.

The government chose to take out Tk1,32,395 crore from banks, which is Tk26,061 crore more than the original FY23 objective.

However, the government's bank borrowing in FY22 was Tk75,533 crore.

GDP is anticipated to be 7.5%, with significant growth forecasts.

However, after Cabinet approval on June 1, Finance Minister AHM Mustafa Kamal will present this budget in parliament as a proposed budget, which is expected to be ratified on June 25 after a lengthy debate.

The new budget will go into effect on July 1.