Many questions have now been raised about offshore banking, which is developed to lend to foreign companies by collecting deposits from foreign sources. While the business of banks' offshore units has stagnated amid the dollar crisis, there has been significant growth in loan disbursements.

In the last two years, the loan disbursements of several banks in this sector have increased, but the amount of defaults of the banks has come down to zero. At least 12 banks with major growth in disbursement of loans to offshore units have no defaulted loans.

According to data from the Bangladesh Bank, till September of last year (2023), Islami Bank had distributed Tk17,957 crore, but there is no record of loan default. Similarly, Agrani Bank disbursed Tk823 crore with no record of default.

In this context, Agrani Bank Chairman Zayed Bakht said: “Offshore banking units are usually given loans for long-term projects. These types of loans have longer tenures. Also, the grace period is much longer. As a result, despite the increase in loan disbursement, there was no incident of defaulting on the scheduled time. These entrepreneurs are paying the installments on time due to borrowing in foreign currency. That is why there is no default.”

On the condition of anonymity, several bank MDs said that the bank's relationship with those who have taken loans from offshore banking units is very good. Because of this, no bank has defaulted in the area. In particular, the bank and the customer - both parties were diligent in keeping this loan regular, so there was no default. Due to the long tenure of these loans, some banks could not default. Apart from this, most importance has been given to the recovery of loans disbursed by offshore banking units. Because of this, these loans were not defaulted.

In this context, former chairman of the BRAC Bank Ahsan H Mansoor said: "The entrepreneurs who own the banks usually take loans from offshore banking units. Banks do not default on this loan even if they do not repay it. One of the reasons for this is that despite being bad, the bank has deliberately tried to look good on paper. Second, some customers have actually paid their loans on time. Thirdly, no bank loan has yet come under default due to long-term project lending.”

According to the data of the central bank, with zero defaults—Prime Bank has distributed Tk5,458 crore, City Bank Tk3,362 crore, and Pubali Bank has distributed Tk3,037 crore. The offshore units of these three banks are default-free. Bank Asia's offshore unit disbursed Tk2,265 crore and the bank has zero defaulted loans. Similarly, Al Arafah Islami Bank has disbursed Tk1,256 crore but the amount of defaulted loans is zero. Dutch Bangla Bank has distributed Tk2,149 crore, Mutual Trust Tk1,777 crore with no record of default loan. The list includes Social Islami Bank which distributed Tk1,940 crore, and South East Bank Tk 1,131 crore. City Bank NA has disbursed Tk1,073 crore as well.

In this context, former chairman of the Association of Bankers Bangladesh (ABB) and Managing Director of Mutual Trust Bank Syed Mahbubur Rahman said: “The reason for zero-defaulters is that most of the offshore unit's assets are in the form of short-term credit. Again, traders have taken short-term foreign loans (buyers credit) for imports from here. Therefore, most of the time alternative financing is arranged to repay the customer's loan at maturity or to repay the bank's offshore short-term credit. That is why most banks have zero defaults on such loans.”

In September 2023, the total debt of offshore units increased to Tk83,826 crores. The defaulted loans of this unit also increased to Tk1,755 crore, which is 2.09% of the total loans. However, in June 2021, the amount of loans given by offshore units of banks was Tk73,387 crore. At that time, the default was only Tk140 crore, which is a little more than 1% of the total loan.

According to central bank data, in 2021, the debt of BRAC Bank's offshore unit was Tk3,454 crore, which increased to Tk5,980 crore in September last year. The default of this bank is now Tk136 crore. Apart from this, the defaulted loan of Eastern Bank which distributed Tk4,207 crore is now Tk207 crore. Out of Tk1,051 crore distributed by Premier Bank, Tk74 crore was defaulted. Apart from this, out of Tk11,554 crore distributed by HSBC Bank, Tk421 crore was defaulted. Another Tk7,950 crore as distributed by Standard Chartered out of which Tk145 crore was defaulted. Meanwhile, out of Tk1,416 crore distributed by Dhaka Bank, Tk158 crore was defaulted. A total of 68% of AB Bank's offshore loans are now in default. Its offshore unit lent Tk777 crore, and the default loan is Tk 535 crore. The defaulted loan amount of foreign sector Uri Bank is Tk36 crore.

Incidentally, both deposit collection and loan disbursement of offshore units are in foreign currency. Due to low loan interest and a good supply of dollars, banks have increased their focus on business through offshore banking units in the country two to three years ago. There was no law in this cases then. The offshore units were operated with money provided by the parent bank.

Bangladesh Bank has recently imposed strict measures due to allegations of money laundering through offshore units amid the dollar crisis. Bangladesh Bank has issued a circular in this regard last December. According to the central bank's new decision, offshore units of banks will not get funds from their own sources as before. Earlier, banks were allowed to transfer funds up to 30% of regulatory capital to their offshore banking unit. Meanwhile, Bangladesh Bank has increased interest rates for foreign banks to keep their funds in offshore units. Besides, the government is also planning to remove the tax on these investments. As a result, the interest rate on loans of offshore units up to one year stands at around 9%. And the deposit interest rate has increased from 7 to 9%.

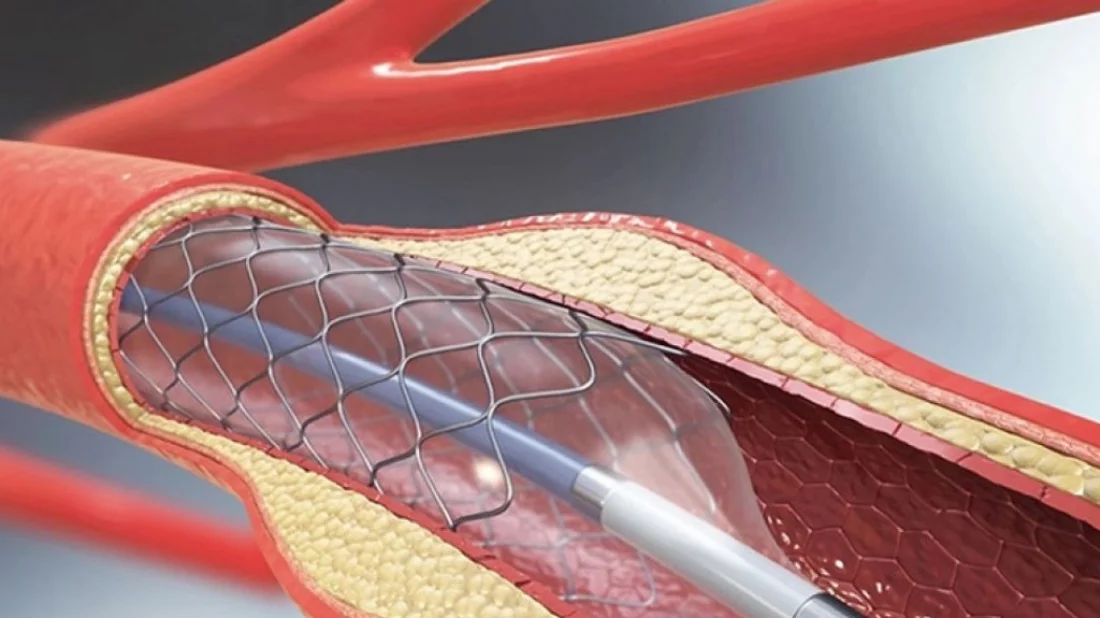

What is offshore banking?

Offshore banking is a separate banking system within a bank. Here, calculations are done in foreign currency. None of the regulations of the scheduled banks of Bangladesh apply to offshore banking. Only the profit and loss accounts add up. Although offshore banking was approved in the country in 1985, the relevant policy was issued on February 25, 2019. Now, 39 banks of the country are doing this business through offshore units.